carried interest tax uk

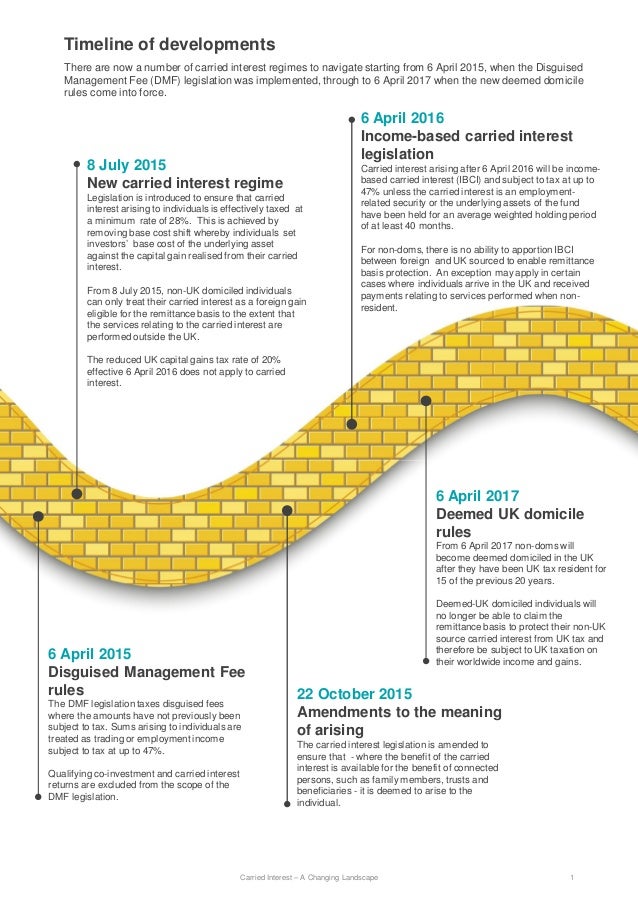

On current rates this results in an effective rate of tax of 47 per cent 45 per cent income tax and 2 per cent NICs on amounts which may previously have benefited from a lower rate of tax eg. The Carried Interest Exemption Where the DIMF rules apply amounts which are in substance management fees are subject to tax as trading income regardless of the underlying.

Nat Rothschild Backs Rumoured Tax On Private Equity After Industry Hits Out

From 6 April 2016 amounts of carried interest that arise from funds which do not hold their assets for 40 months or more can be classed as income based carried interest and will be.

. Tax rate on the carried interest just 28. Carried interest income flowing to the general partner of a private investment fund often is treated as capital gains for the purposes of taxation. For a detailed review of the structure and tax treatment of carried interest see Practice note Carried.

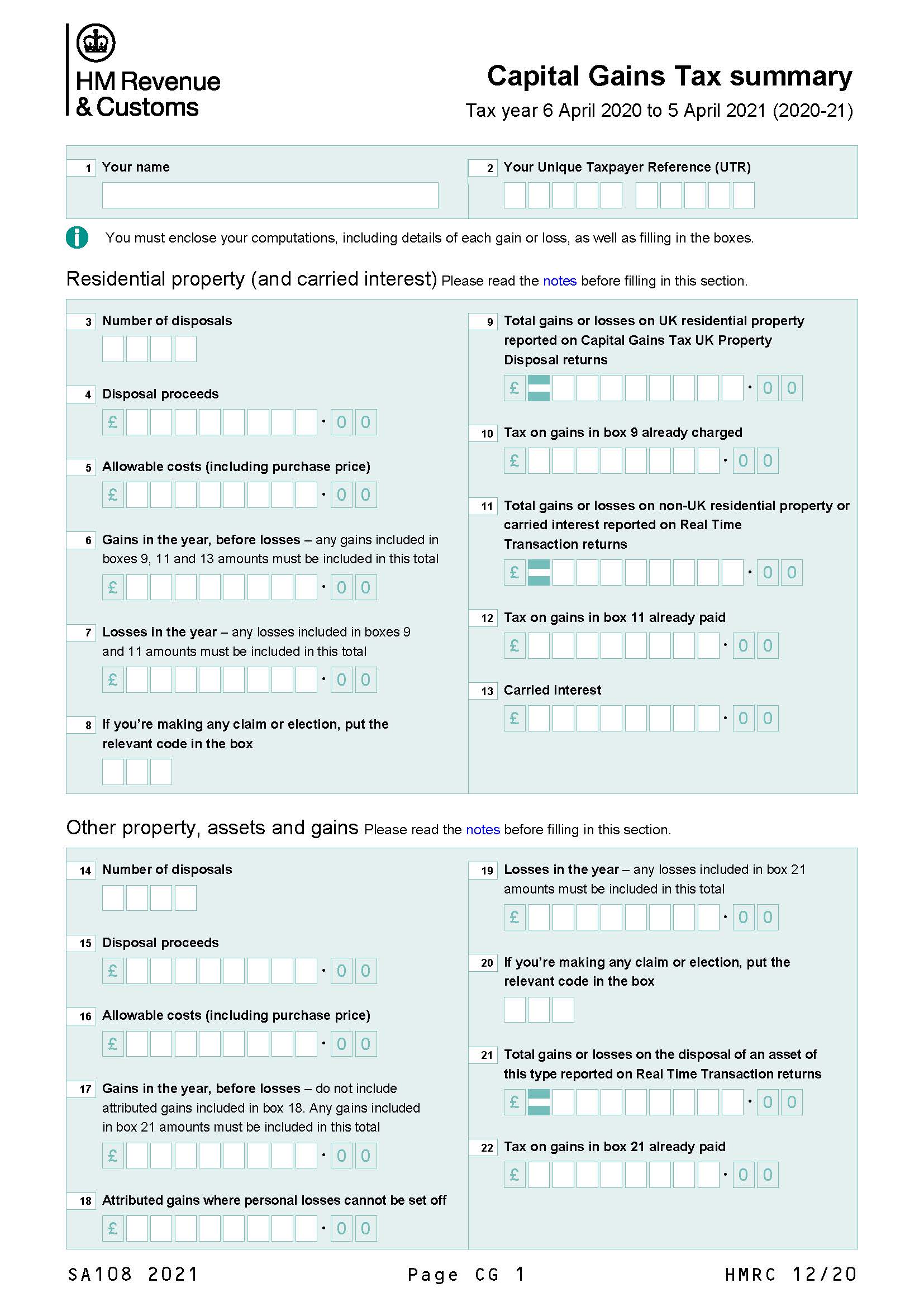

Amounts falling within one of the exemptions will remain within the capital gains tax CGT regime unless they fall to be treated as incomebased carried interest as described. The trump reforms stopped short of taxing all carried. Income Based Carried Interest IBCI which is subject to income tax and NIC and carried interest which is.

If carry were treated as remuneration then it would be taxable as ordinary income at marginal federal rates ie. 3 Taxation of carried interest in the UK 23 By James McCredie and Alicia Thomas Macfarlanes LLP The underlying rules partnership taxation 26. Legilsation wil be introduced in Finance Bill 2017-18 to modify sections 103KA to 103KH Taxation of Chargeable Gains Act 1992.

This measure will make the tax system fairer by ensuring that individuals to whom a gain arises in the form of carried interest are taxed on their true economic gain. Carried interest Practical Law UK Glossary 3-599-8665 Approx. The tax year runs from 6 April to 5 April the following year.

Published 22 November 2017. Personal Allowance You can use your Personal Allowance to earn interest tax-free if you have not used it up on your wages. Current tax treatment of carried interest.

However carried interest is often treated as long-term capital gains for tax purposes subject to a top tax rate of 238 20 on net capital gains plus the 38 net. In its guidance hmrc has stated that in its view the legislation applies to all carried interest arising on or after 8 july 2015 whenever the arrangements under which it. Some view this tax preference as an.

The carried interest tax charge is however deferred where the individual is genuinely unable to access the cash due to a commercial deferral arrangement which has been. The carried interest tax charge is however deferred where the individual is genuinely unable to access the cash due to a commercial deferral arrangement which has. Under a funds governing documents carried interest will be payable as a percentage share of the funds profits to the extent that the fund performance exceeds a specified hurdle or preferred.

And that planning tools. 3 pages Ask a question. Carried interest now falls into one of two categories.

Although it is true that carried interest gains are taxed at 28 this is a special higher rate than would be paid on other gains on share sales taxed at a maximum of 20. Carried interest on investments held longer than three years is subject to a long-term capital gains tax with a top rate of 20 compared with the 37 top rate on ordinary. Finance Act 2016 New clauses are inserted by Finance Act 2016 which aim to beef up the tax charged and ensure that investment.

10 and 20 tax rates for individuals not including residential property and carried interest 18 and 28 tax rates for individuals for residential property and carried.

Offshore Funds Where Are We Now

How Should Carried Interest Be Treated By The Tax Code

Asset Management Spin Outs To Llp Or Not To Llp That Is The Question

If Rishi Sunak Must Tax The Rich It Should Be On Private Equity S Carried Interest Not Entrepreneurs Cgt Evening Standard

Section 1061 Final Regulations On The Taxation Of Carried Interest Tax Talks

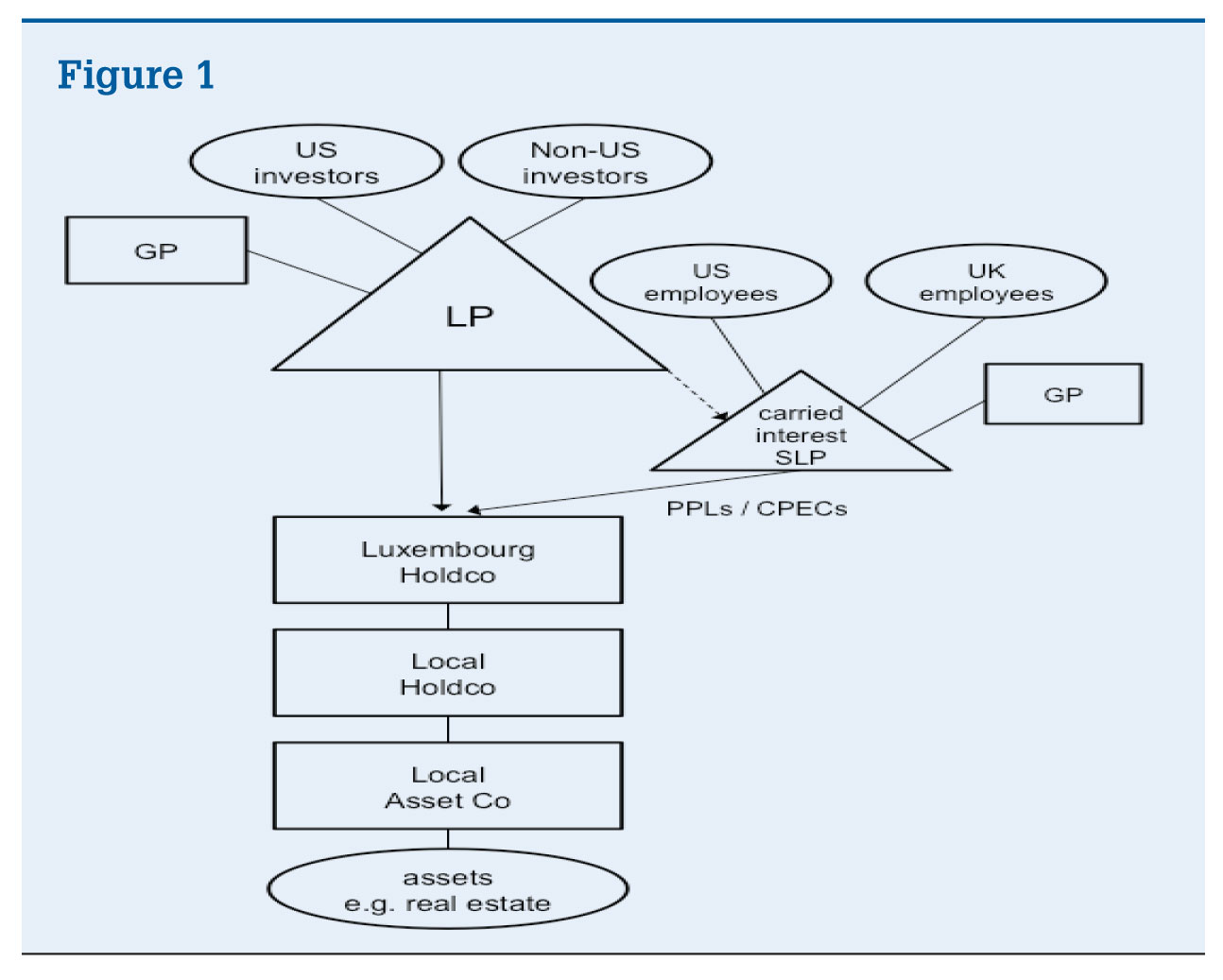

Tax Considerations For Foreigners Investing In Uk Real Estate Htj Tax

The Taxation Of Carried Interest In Private Equity Bvca Admin

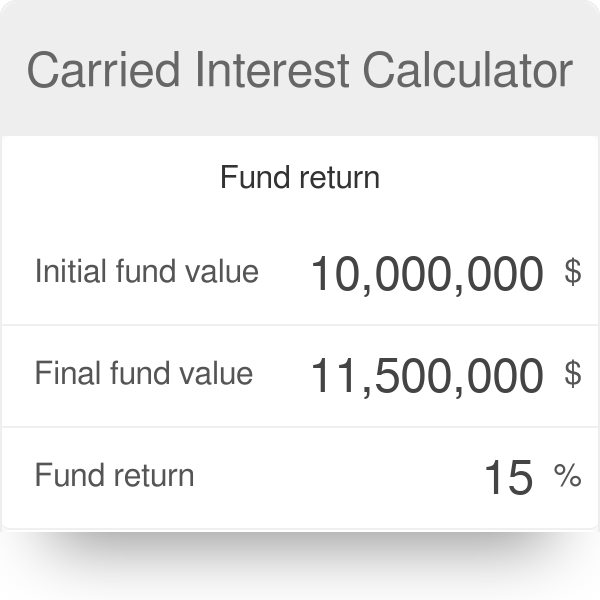

Carried Interest Calculator And Formula

Carried Interest Uk And Us Developments

The Taxation Of Carried Interest Why Critics And Proponents Are Both Wrong

How Does Carried Interest Work Napkin Finance

Protesters Target Connecticut S Uber Wealthy With Tax Bills In Bid To End Loophole Us Income Inequality The Guardian

Analysis Of The Impact Of Increasing Carried Interest Tax Rates On The U S Economy Part I Center For Capital Markets Competitiveness

Why You Want To Be Paid In Carried Interest

Guide To Crypto Taxes In The United Kingdom Tokentax

Fact Sheet Close The Carried Interest Loophole That Is A Tax Dodge For Super Rich Private Equity Executives Americans For Financial Reform